Chief Garcia and I'm going to be talking to you about the Department of Defense Form 1348 Tech 1 Alpha, more commonly known as the GD Form 1348, as well as some of the basics about military standard requisitioning and issuing procedures. I'm going to be referencing the Naphtha P409, the Mill Strip Death Guide, and again, Mill Strip as we scroll down. Mill Strip stands for military standard requisitioning and issue procedures, and Mill Strap stands for military standard transaction reporting and accounting procedures. So, first, let's look at our DD Form 1348. You will notice that it is a pretty simple looking form. You can tell you're working with the correct form by looking over here to the bottom left, and there you see DD Form 1348 Tech 1 Alpha. The TAC 1 Alpha is the version with the barcodes. The first block is the document identifier block, and if you're not familiar with any of the blocks, that's why we also have the Naphtha P409 open. I like the way the Mill Strip Mill Strap Naphtha P409 is presented because it's presented according to the number of the Mill Strip. For instance, as we scroll down past the Julian date for non-leap years and then for leap years, you will see that Part A is the Mill Strip and the document identifier, which is record positions one through three. And if you look back at our 1348, you will see document identifiers for extra positions one through three. So, we're going to use these two greens together because they're going to help us understand what we're doing. And again, let's go back to the P409, and you will notice the document identifier is our first three positions. So, first, we need to figure out what it is...

Award-winning PDF software

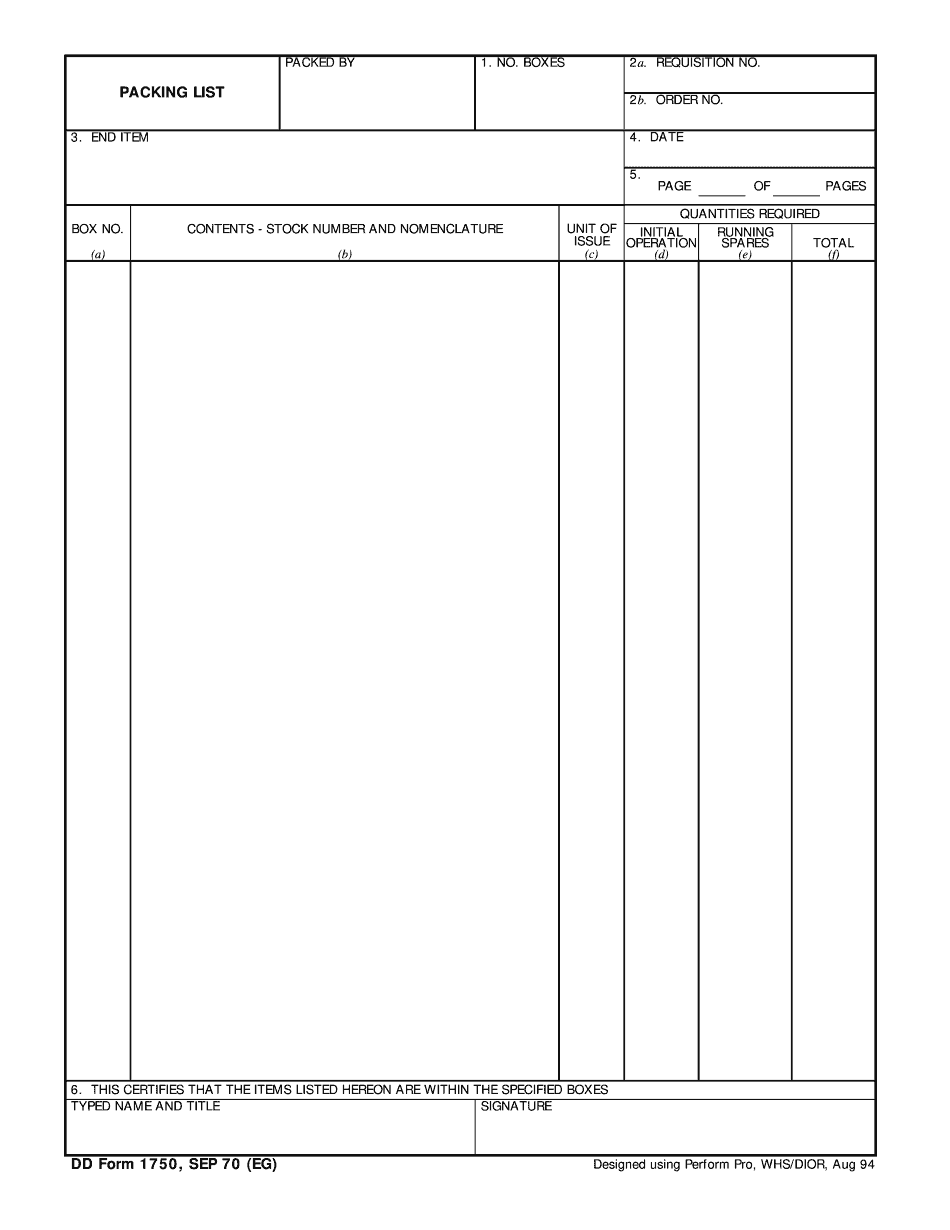

Dd 1750 Army pub Form: What You Should Know

A form 5498 is no more than an annual report to the IRS showing the amount you contributed to an IRA during the year. Form 5498 can be filed in either paper or electronically. However, you need to have both forms filed, to ensure you have all the information in your name and that you are responsible for the information on your return. If you file electronically, you need to have complete and accurate information on your return, as well. How the IRS Uses Form 5498 and Other Reporting Tools It can reveal which transactions are tax-deferred retirement accounts such as IRAs. It can also indicate whether you are an individual taxpayer, a business entity. It can help determine whether you owe any money back taxes. Furthermore, it can help determine if you are self-employed and make sure you can access all of your tax filing privileges If you are unable to file an individual or business return by your deadline, the IRS will contact you for further information. If you owe money back to the IRS (and need to have the funds collected, in order to file your tax return), then the IRS may charge a penalty. Form 5498 FAQ. This link contains some answers to frequently asked questions about Form 5498. Form 5498 Frequently Asked Questions (FAQs.) This link contains answers to frequently asked questions about Form 5498. Form 5498 and Other IRS Reporting Tools What is Form 5498? This IRS form enables the taxpayer to report certain income from an IRA and other tax-deferred retirement accounts, including Roth IRAs. These accounts may be the 401(k) or IRA. If I get Form 5498, will I also have to report any other Roth IRA contribution information and earnings? Most people who file Form 5498 have to report all the following information (the IRS would require only one Form 5498 for Roth IRA reporting): The total amount of money you contributed for the year; Any Roth or Traditional IRA contributions in excess of 5,000; If any payments have not been made to the IRA, or the balance in the IRA exceeds the contribution limit, the total payment you were required to make toward the payment of the balance What does it mean if I contribute an amount between the contributions limit of 5,000 and the payment limit of 10,000? This is considered a combined Roth IRA contribution and payment to the IRA.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Dd 1750, steer clear of blunders along with furnish it in a timely manner:

How to complete any Dd 1750 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Dd 1750 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Dd 1750 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Dd 1750 Army pub