True," a lot of people are really thinking that everything they do through these apps is going to be put on this 1099k and they're going to pay taxes on it, and that's just... that's not true. So, Music, today we want to talk about some keywords: 1099k and a new hundred dollar limit. There are a lot of people out there that are, for lack of better terms, kind of freaking out over getting a 1099 because they're selling or transferring money through an electronic service. One of those may be Venmo, PayPal, Cash Out, yeah. And I think Debbie, we had a conversation before we started this presentation and I thought the real good news is that if I'm using like Venmo and I'm just transferring money, if I set it up right and I'm doing it right, starting now, when we get to the year, then you won't be reporting those transactions. So, that was my real takeaway in our discussion. So, the first thing is the law changed. It changed in March of 2021, saying that starting January 1st of 2022, that anything like credit cards, under a certain amount, things like PayPal, third-party transactor, Venmo, you know, eBay, all those things, now are going to have to report a 1099k if the if you or I have transactions of over $600. Right, and let's step back a minute. 1099k is not a new thing, yeah. The limit, though, on that used to be $20,000. So, this was not on the radar of a lot of our small businesses because they just weren't worried about it. Or if you were selling your kids' old shoes that they're done with on eBay, you were never thinking about getting a 1099k. So now the 1099k has really moved onto...

Award-winning PDF software

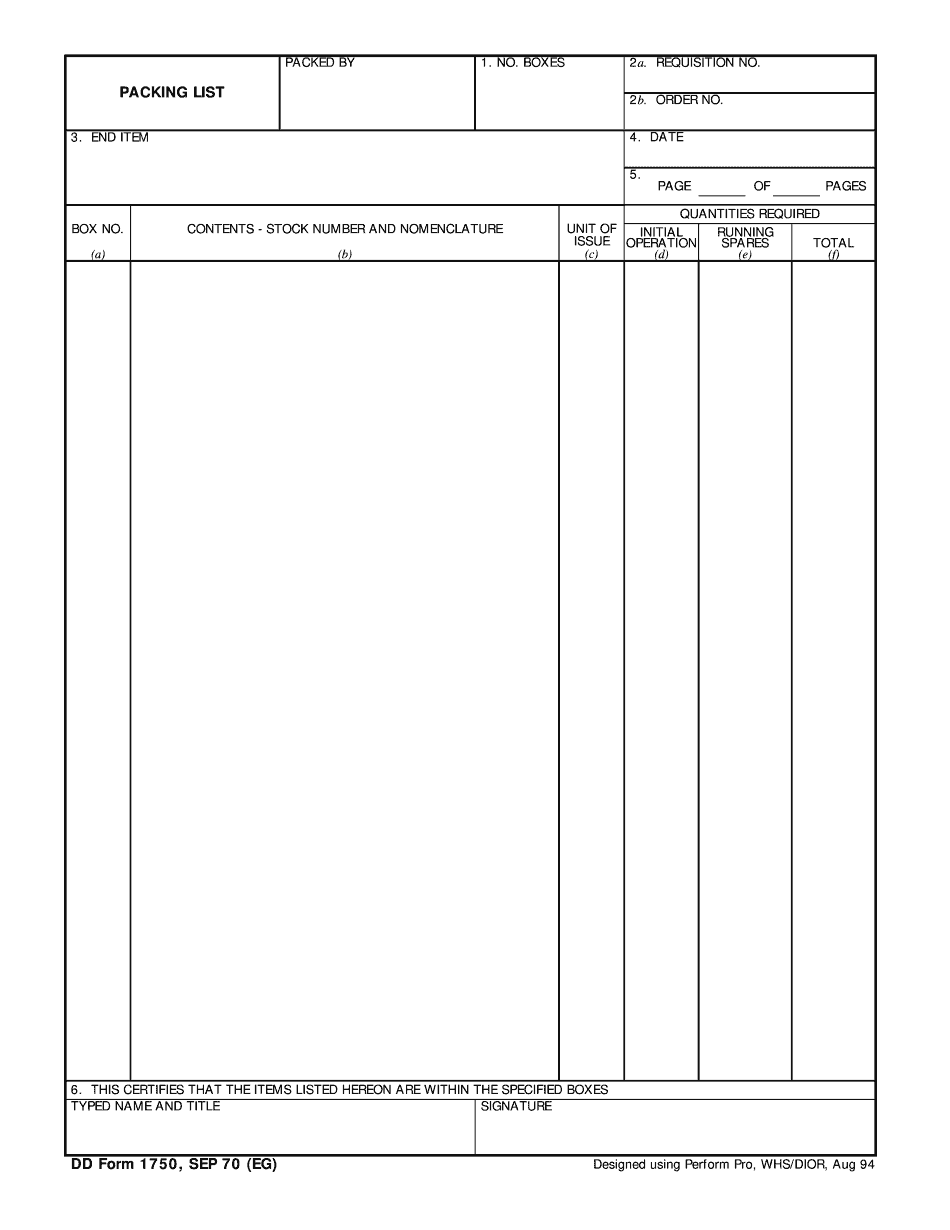

Video instructions and help with filling out and completing Dd 1750