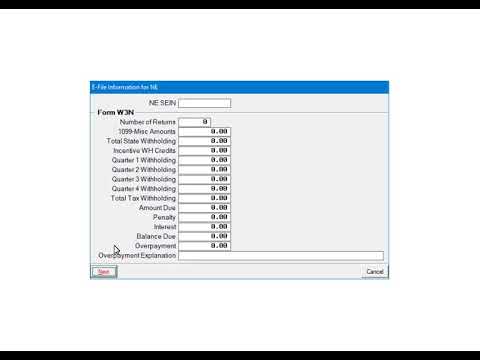

True" welcome to the 1099 ATC program. This tutorial covers filing the 1099 miscellaneous forms to Nebraska using efile services. Only the 1099 miscellaneous form can be e-filed to the state using efile services. To begin, the pair ABC payroll has been created and the 1099 miscellaneous form data has been entered. This is the main menu. To continue, select a filer. This is the e-filer menu. Select efile services. Now click OK. In order to use the e-file services, you will need to create an account with a user ID and password. The user ID can be up to 30 characters in length. The password must be at least 10 characters in length and include one uppercase letter and one number. This information logs you into the third-party system so that you can submit the information for processing. The login information entered should be for the user submitting the data. All fields in red are required, while the others are optional. You can also elect to remember your password so that you will not be prompted to enter it again in the e-filing process. The transmitter is the person submitting the file, not the company being submitted. Fill out all of the required fields and click Submit. In a few moments, you will receive a message that the account was created and/or updated successfully. If you receive an error, correct and resubmit. Click OK to continue. Once the account is set up, we are ready to e-file. Select create new batch. Here are the e-filing options. You can only select the 1099 miscellaneous form. Select 1099 as the form and miscellaneous as the form type. Next, select the services for this batch. Select a file to state and then Nebraska. Click OK. This is the transmitter screen. Filling it out is optional, except for...

Award-winning PDF software

Video instructions and help with filling out and completing Dd 1750