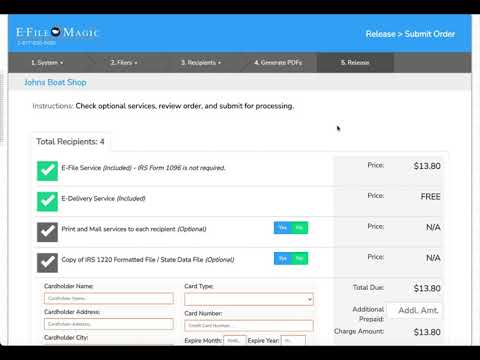

True", okay. In this video, we're going to be talking about releasing your information for processing by the e-file magic service bureau. Before we begin, let's talk a little bit about the workflow process within e-file magic. The first thing that we start with is creating filers. The second thing that we do is managing recipients. The third thing we typically do is generating PDF forms. And the very last step is releasing the information for processing. Why is releasing the information for processing important? Well, right now if we navigate back to our dashboard, you'll note that I have four recipients that are unreleased for John's Boat Shop and one recipient that's unreleased for a Big Toy Store. Until you release your information for processing, e-file magic will not e-file it with the IRS, will not print and mail the forms for you, and will not provide any other services that you request us to provide until you've released it. So you can think of releasing as that final step that says, "Okay, I'm done with my data, and now I'm ready for my data to get issued to the recipient, for the forms to get printed if you elect print and mail, and for the IRS to receive the information and complete my compliance requirements." Since we're ready to go, let's go ahead and release information for processing for John's Boat Shop. So once logged in, let's confirm that John's Boat Shop is my active filer, which I can see that it is here because it's in my global filer section. But if I needed to change filers once again, I could go to "To Filers" and down to 1099 and select a different filer. Since this is the appropriate filer, I'm going to go ahead and go to release. At this...

Award-winning PDF software

Video instructions and help with filling out and completing Dd 1750