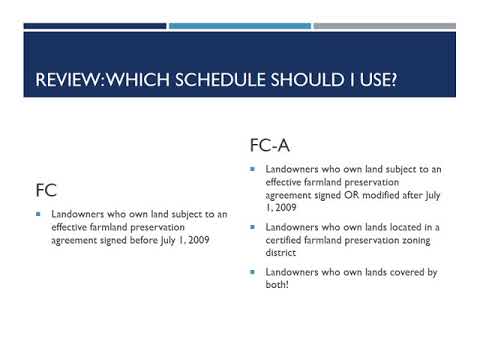

True", the farmland preservation tax credit is a refundable income tax credit available to Wisconsin landowners. There are different ways to claim the credit, depending on how the land is enrolled in the program. The short tutorial explains which tax schedule to use when claiming the credit, which eligibility requirements must be met in order to claim, and what documents to attach when filing. The farmland preservation program is made up of four basic components. First, the farmland preservation plan. Second, farmland preservation zoning. Third, agricultural Enterprise areas. And lastly, farmland preservation agreements. Individuals who own land in a certified farmland preservation zoning district, or own land covered by an effective farmland preservation agreement, may be eligible for an income tax credit. To claim the credit, claimants will need to file either tax form F C or F CA. For more information on any pieces of the program, please visit our website at farmlandpreservation.wi.gov. If a landowner has land covered by a farmland preservation agreement entered into before July 1st, 2009, then that landowner should use tax Schedule F C. This includes agreements that were submitted to the county clerk between January 1st, 2008, and June 30th, 2009, but may not have been signed until after July 1st, 2009. Fewer landowners should be using this tax form each year. Landowners using tax Schedule F C do not need to attach a certificate of compliance to their tax forms. To verify that you should be using tax Schedule F C to file a claim for the farmland preservation tax credit, you should ask for a copy of the agreement. You should check the agreement's expiration to make sure the claim is not being based on an expired agreement. If you need help determining what kind of agreement applies to your client's farm, please contact DEBT...

Award-winning PDF software

Video instructions and help with filling out and completing Dd 1750