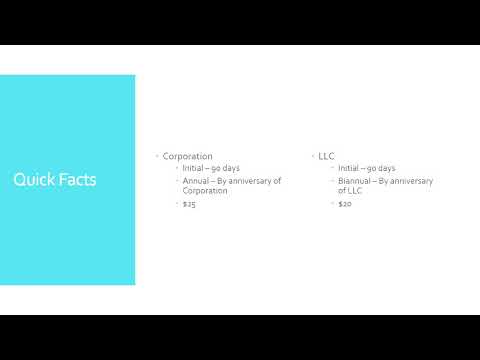

True," hey, I'm Jake with a lesson in total. And today, we're going to talk about the California Statement of Information. What is it? Well, it's a form that's required to be filed by corporations and LLCs with the California Secretary of State. The form discloses certain information about your entity to the public, should they wish to know. You can go online, type in the name of a business, and see who is in charge, the contact person, mailing address, and the place of business. It's important to note that this information is public, so if your business operates from your home and you don't want your home address out there on the internet, it's probably a good idea to get a P.O. or some other form of address. Let's take a look at some quick facts about the Statement of Information. It applies to corporations and LLCs. Sole proprietors are exempt from this requirement. Corporations must file this statement within 90 days of becoming a corporation, and then annually by the anniversary of their corporation. The filing fee is $25 each time. LLCs have a similar requirement, but they only need to file once every two years after the initial statement. The fee for LLCs is $20. Why does this matter? Well, the Secretary of State works closely with the Franchise Tax Board. They communicate about who's filing and whether you're in good standing with them. Failure to file the Statement of Information can result in the suspension of your business, just like failing to file your tax return puts you in bad standing with the Franchise Tax Board. Additionally, not filing these forms can lead to a monetary penalty of up to $250. So, how do you file? You can find paper forms available online, but the best way is...

Award-winning PDF software

Video instructions and help with filling out and completing Dd 1750