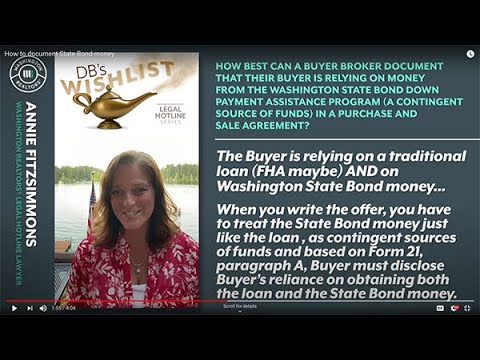

True." Hi, I'm Manny Fitzsimmons. I'm your Washington Realtors Legal Hotline lawyer. Welcome back to our video series entitled "DB's Wish List." My question to you is, how best can a buyer broker document that their buyer is relying on money from the Washington State Bond Down Payment Assistance Program for their buyer? These are contingent funds. How best can the buyer broker document that in a purchase and sales agreement? Thank you. Okay, let's set the table for what's happening in this transaction. The buyer is relying on not only a traditional loan, probably an FHA loan, but also Washington State Bond money. Washington State Bond money is not traditional financing, but the buyer still has to qualify for the bond program. The buyer may or may not get the Washington State Bond money. So, buyer brokers, when you write the offer, you have to treat the State Bond money just like the FHA loan as contingent sources of funds. And based on Form 21, paragraph A, the buyer must disclose buyer's reliance on obtaining both the traditional loan and the State Bond money. So, this question is asking how do we disclose buyer's reliance on the State Bond money. There are two ways of doing it, but one is far superior to the other. The way that I don't recommend you disclose buyer's reliance on the State Bond money is to use a Form 22EF. If you were going to do that, the buyer would include the Form 22A and identify their traditional loan (FHA probably) and separately, on a Form 22EF Evidence of Funds Addendum, the buyer would disclose that they're relying on State Bond money. The problem with doing it that way is you've got to remember what Form 22EF is. It is not a contingency addendum. It is an...

Award-winning PDF software

Video instructions and help with filling out and completing Dd 1750