Hi can you guys hear me good good good let's get started yes get started we're going to talk today about international fuel tax agreement the international fuel tax agreement i hope you guys are getting it in like we're getting it in and and the overflow is coming and it's coming in and keeping you guys busy we're just going to get started here and dig into how to file these if the tax returns for our clients remember earlier we said that this is uh this is part of what we offer as an additional additional service services here the turkish bookkeeper and we and we we we enjoyed doing this um as as at the end of the day we were accountants right we're bookkeepers and so this is dealing with the numbers and we're always interested into getting into the bottom of this of this uh type of work right so let's pull up here this there it is there's the show i was looking for so let's get started here and uh the subject is how to file your if the quarterly tax returns or the international food tax agreement quarter returns that's due every single quarter you have to follow no matter what um no matter what the situation is these things need to happen and what you're doing is you're assigning as on as an agreement so in other words if it's not a if it's not an agreement if if the taxpayer the if the tax pair is not a member of the international fuel tax agreement if they're not a member then chances are they're paying the trip permits right chances are they're paying for the trip permits okay if they're not paying for the trip permits then chances are they...

Award-winning PDF software

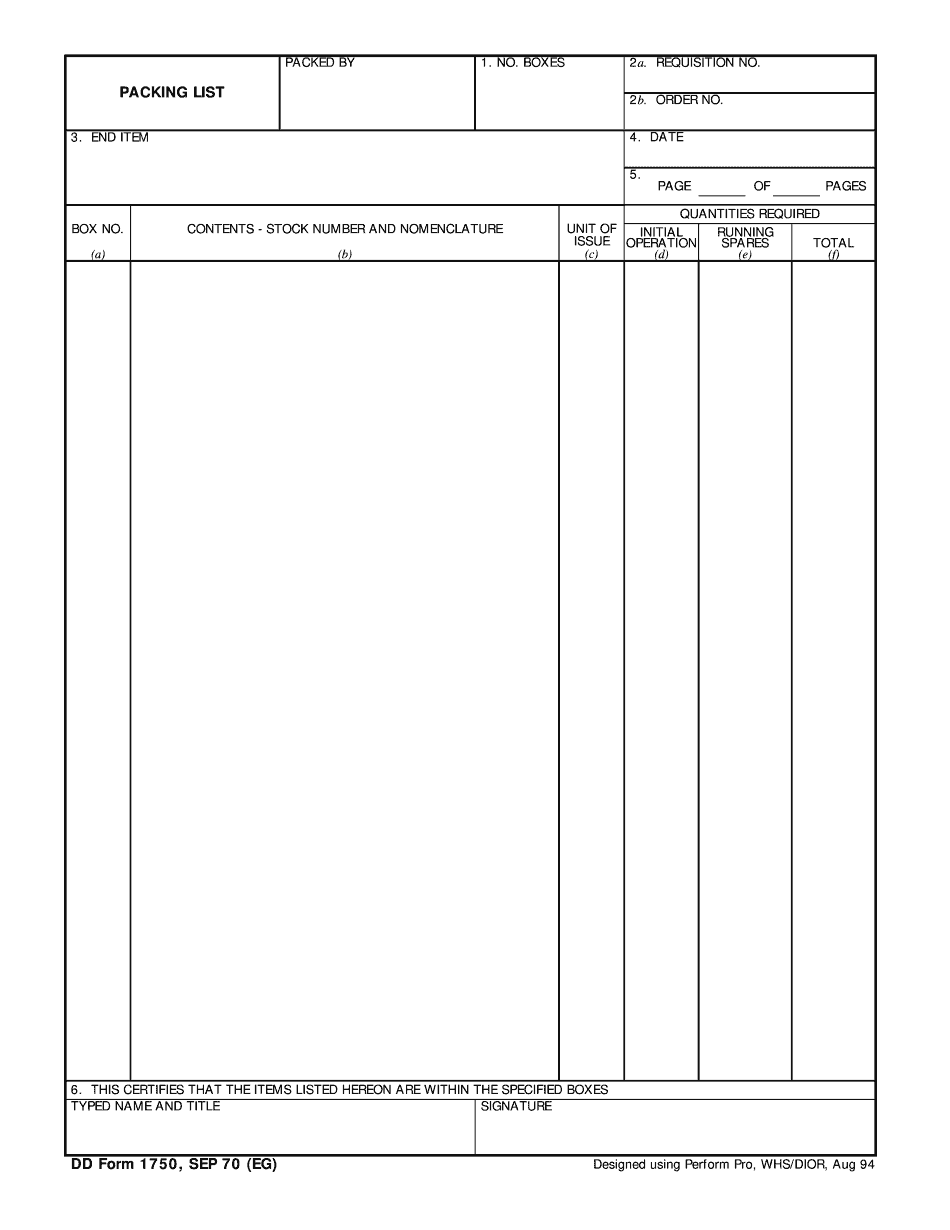

Video instructions and help with filling out and completing Dd 1750