True" Welcome back to the channel. Today, I'm going to show you how to file and pay your quarterly Kentucky Weight Distance Tax. There are several states that require quarterly filings along with your fuel tax. You can do them all about the same time, and Kentucky is one of them. But luckily, Kentucky is one of the easier states to file, so this really isn't going to be too long. There's not too much to it. But if you're an independent owner-operator, this is one of the things you have to do when you have your own authority. You can outsource it to a permit company or somebody else, but it's really very simple. So maybe you've never done it before, but it's not a daunting task. So maybe check this video out, and you'll see that you could probably do it yourself and save a little bit of money. Now, in regards to Kentucky, when you have a Kentucky KYU number, make sure there's something that goes along with that for the state of Kentucky that a lot of people forget, and the consequences will get you a ticket the first time you pull into a Kentucky weigh station. That is that you need to have your truck listed on your Kentucky taxable inventory. In the website, the same place where you file your Kentucky quarterly return, there is a section there for your taxable inventory. In every quarter, I just take a look at mine and make sure that nothing happened to it. I don't change it, but you know how things go on the other end and they make mistakes, so I just check on that once a quarter when I do my filings. So we're gonna flip the screen around here, and I'll walk you right through...

Award-winning PDF software

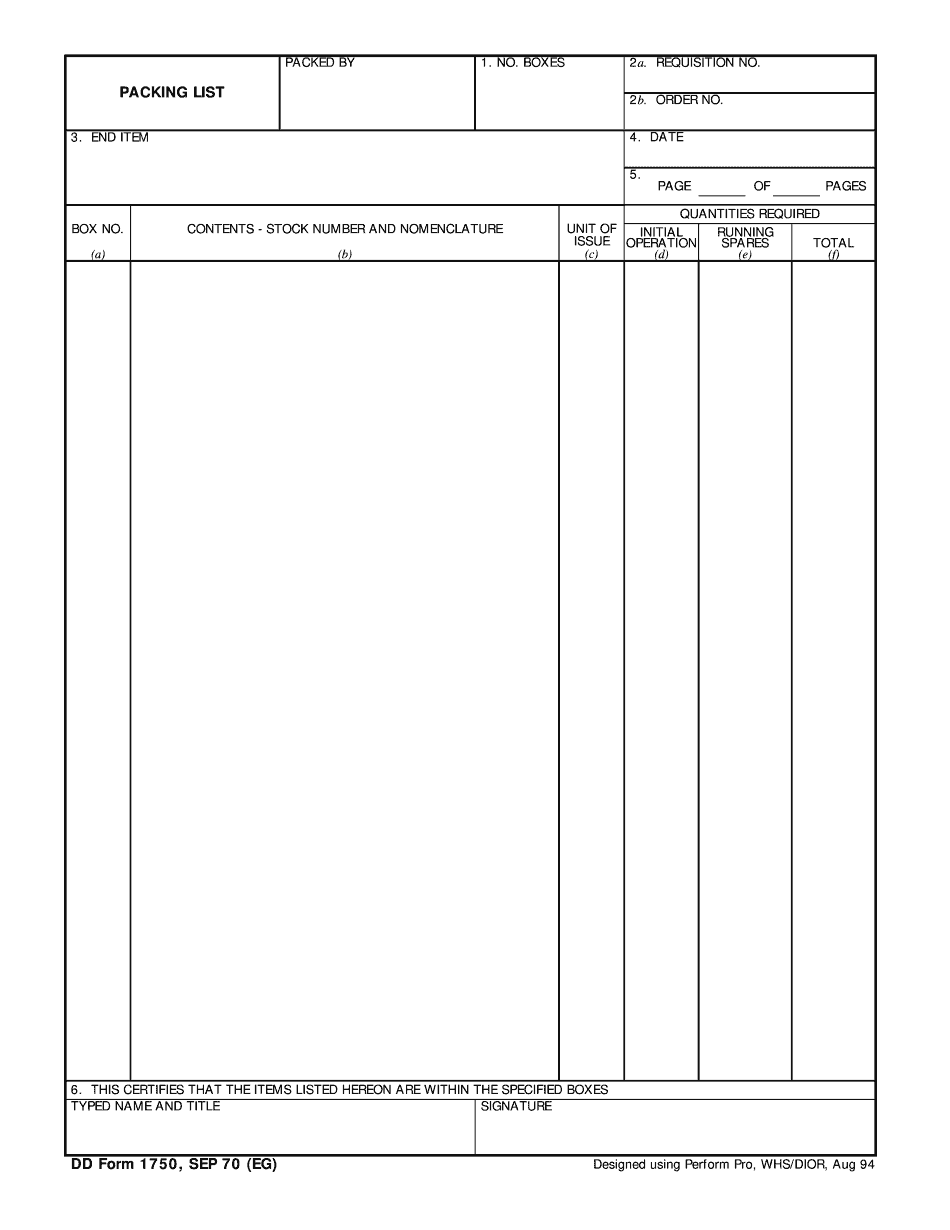

Video instructions and help with filling out and completing Dd 1750