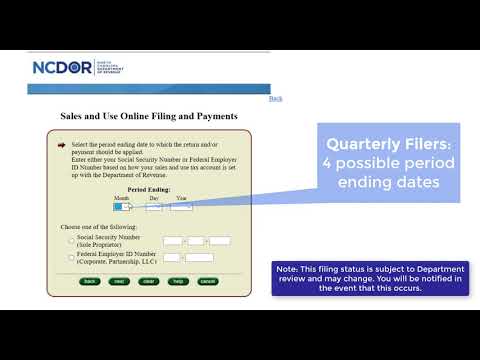

True," this video will guide you through filing a basic online sales and use tax return. The information in this video is for illustration purposes only and is not considered specific tax advice for you or your business. It does not address all the lines of the sales and use tax return. If you have specific questions about the return, refer to the form e-500 instructions on the website or call the department for assistance. If you need to file and/or pay North Carolina sales and use tax, you can do it online at ncdor.gov. Once there, click "Taxes and Forms," then click "Sales and Use Tax." Next, click "File and Pay E-500" on the right side of the page. Note that there are multiple ways to access the filing and paying option for a North Carolina sales and use tax return. Before we get started, let's take a moment and review the help feature that can be found on this page. Within this document, you will find assistance and common questions that you might have when filing a sales and use tax return electronically. For example, it will assist you in selecting the correct filing option, as well as line-by-line guidance on completing a sales and use tax return form E-500. Once the online file and pay page loads, enter the contact name. Use the person's name that is filing on behalf of the business or taxpayer. Then enter the contact email address. Use the email address that you would like your sales and use return confirmation sent to. Finally, enter the contact phone number. Use a working phone number that you can be reached at in case there are questions referencing your account. Then click "Next." Enter the account ID you were given when you completed the business registration form with the...

Award-winning PDF software

Video instructions and help with filling out and completing Dd 1750